Diversity Is Difference

“Ideas are not real estate” said Robert Rauschenberg, the American artist. I wish it held true in the business world. Because ideas are bought, sold and poached all the time, but they are still not shared enough together with experience and two-way learning and mentoring opportunities in collaboration towards a common goal. It might be a useful way of thinking about our approach in the UK in the drive for gender diversity and progression.

Despite a decade of worthy and much-hyped initiatives and some progress, achievements are disappointing when it comes to any real shift in the country’s power base regarding gender. Teetering on the cliff-edge of Brexit has become a national preoccupation. But progress on gender equality could be critical to both the UK’s productivity problem and to its seemingly growing inter-generational and social divide. The issues seem likely to be intertwined and better, ethical corporate governance can bring them together.

Although diversity has firmly claimed its place in the ESG spotlight being shone by investors and regulators, it feels like a very slow trajectory in its effective implementation. Gender diversity – by sheer weight of the numbers involved - is needed to bring people who think differently together at senior levels to play a part for broader perspectives and better outcomes for business and society.

Media scrutiny of each woman who becomes a CEO waiting for a chance to say FAIL is not the way forward. Each man newly appointed does not need to prove himself with every move. Instead we should be finding more ways to bring to light all those who are succeeding at different levels within their businesses, and bring them together across industry sectors to share their ideas.

At an invitation-only event among women in finance at the Norwegian Embassy in London earlier this week, I was asked to moderate a discussion. Like the best discussions, it needed little help to get going, and it cast an important light on the continued need to fight for, and publicise the need for, culture change as part of better corporate governance.

We heard from women on different ways of approaching issues. Flexible working is not an issue that should be relegated to an HR department, for example – because it is a critical part of an overall attitude to attracting the best talent. If you want the best, you need to respect people’s decisions all the way from how they dress – on which, see my piece on Forbes a few years ago - to how they wish to manage work and life.

“Progress is impossible without change, and those who cannot change their minds cannot change anything.” The man who is noted for saying that - George Bernard Shaw – was right.

We must stop pretending we are trying to achieve gender diversity without also achieving widespread cultural change in organisations around the very structure of jobs. Women are very bored of being told to ‘lean in’, while telling them to network for success as they rise through an organisation merely reinforces an existing elite. It also does nothing for the government’s dual drives of inclusion and social mobility.

It is probably nigh impossible to achieve gender diversity in any substantial way without a mix of cultural change and better child care infrastructure. The UK’s ranking in childcare is shocking. The UN children’s charity Unicef made it clear in June 2019 that the UK and Ireland are among the worst places in Europe for paid parental leave and affordable quality childcare. Childcare is still seen, and often talked about, as a ‘women’s issue’. Perhaps it is time that businesses paying lip service to gender equality consider providing it themselves for all parents.

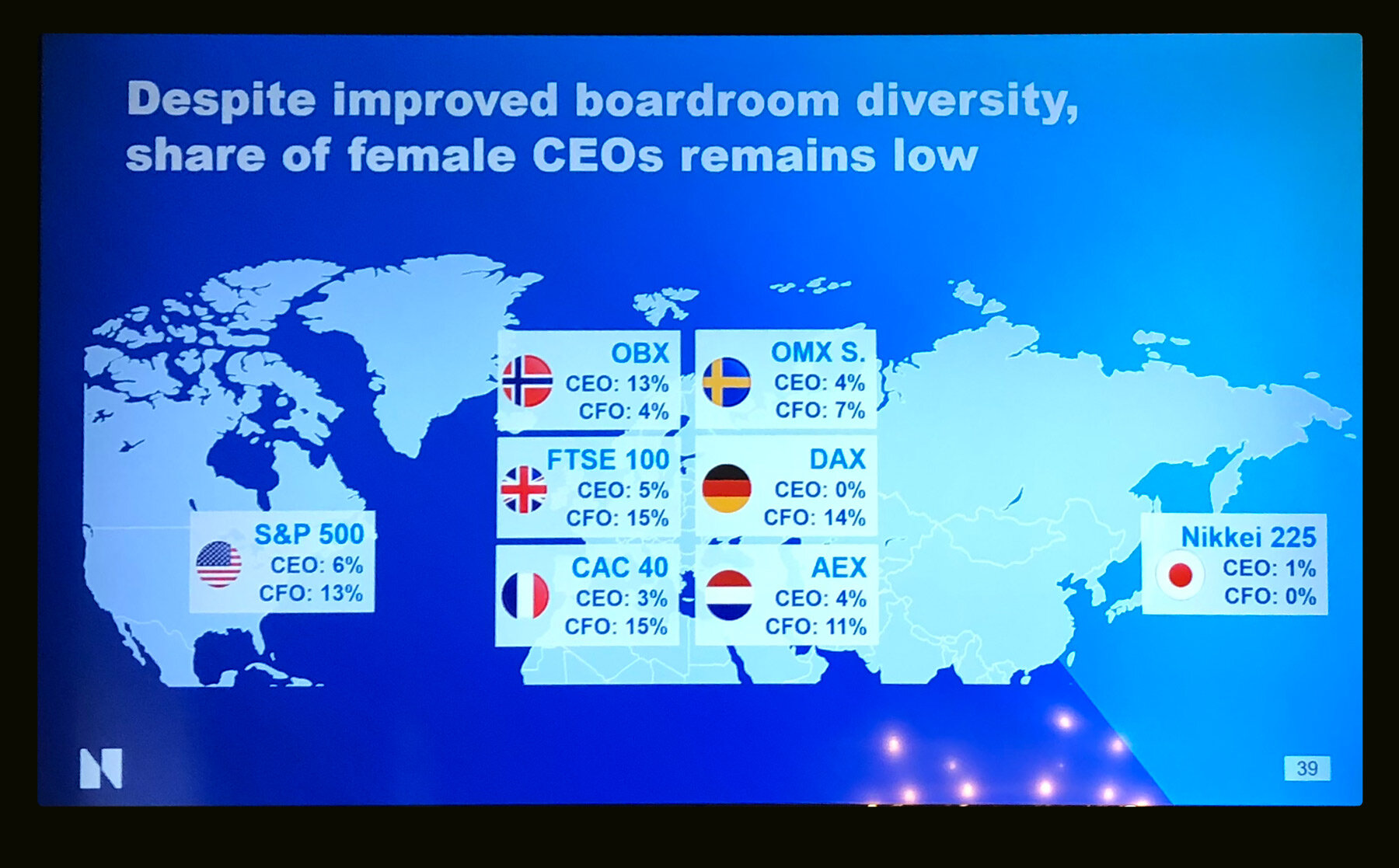

Progress in getting far more women into FTSE350 boardrooms – but not into positions of power as Chair and CEO – is testimony to some of the barriers that exist across the globe, but could be tackled better.

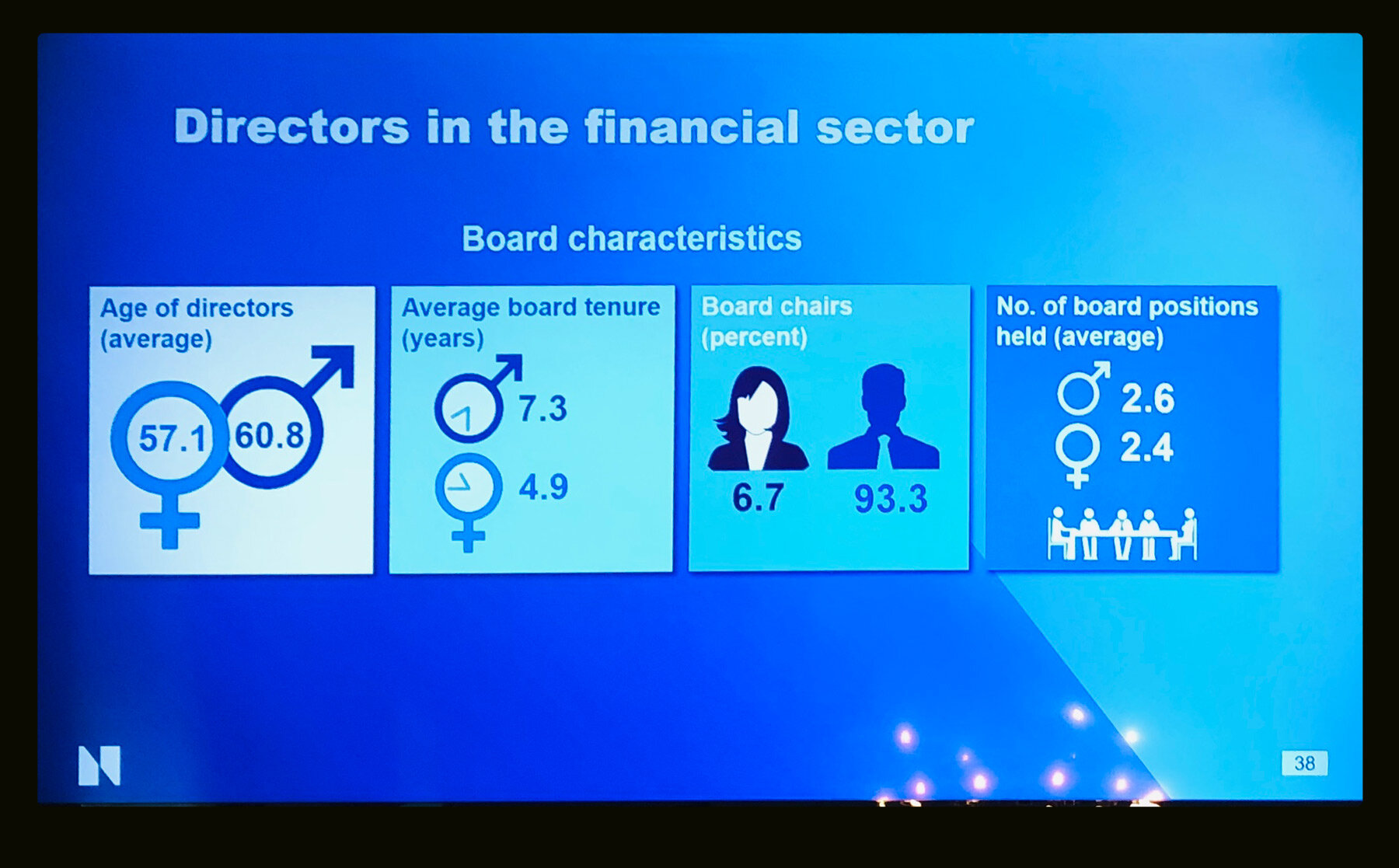

Slides were part of a presentation made at the Norwegian Embassy in London, October 16, 2019 at a seminar organised by Future Boards, Oslo.

The drive for culture change everywhere in business clearly starts from the top – resting heavily in the Chair, and the CEO. UK business has been handed an opportunity to do something substantial here, given the longevity of Chair tenure. But there are also those who will not be budged from a mind-set.

Directors and Groupthink

Quite apart from gender, the skills, perspective and mind-set of directors who are being appointed is clearly critical to any business, and to stakeholders watching its governance.

Recent coverage in the Financial Times revealed that female candidates accounted for 42% of UK appointments in 2018, the third highest of the countries included in a recent monitoring survey of Europe, behind Portugal and the Netherlands. But, as the FT points out, as the UK prepares to leave the EU, “the make-up of the British board is clearly more domestic than counterparts overseas, with the fewest number of non-UK appointments to the top positions of any EU country studied in the report, at about a third.” Although on its own that might not seem a significant statement on cultural insularity, it also does not suggest a trend towards greater diversity.

Investors

Investors are picking up their pace when it comes to paying attention on diversity, and the UK’s Stewardship Code revamped will bring diversity in place with ESG as an essential part of corporate strategy and investor scrutiny. But many investors still remain reluctant to talk specifically about gender.

The Investment Association, which represents investors with assets totalling £7.7 trillion, has targeted companies that do not have women on their boards and LGIM has led the way on voting against companies by using its own gender diversity score to assess them.

A significant recent development with the potential to raise the bar on scrutiny and engagement by investors comes from Norway. Norges Bank Investment Management- which manages the country’s oil fund, one of the world’s biggest investors- states in its latest strategy report that by the end of 2022 it aims to publish all its voting instructions ahead of shareholder meetings where practicable. It has tended to steer clear of publicly discussing gender to date, but it has steadily become a more active investor on ESG issues.

Follow us on Twitter @ABExcellence

You can find us at Advanced Boardroom Excellence on LinkedIn